The Hedge Account Balances widget displays the hedge accounts and the futures contracts balances that an authorized HM customer is managing. This information comes from the HM exchange and helps track which hedge orders cover which cash orders. This is part of our solution to assist the merchandiser with managing the tails or the quantity of a commodity that doesn't fulfill the quantity of a standard futures contract.

For example, the farmer sells the merchandiser 16,000 bushels of corn. The merchandiser hedges 15,000 bushels with 3 futures orders on the CBOT and the remaining 1000 bushels is the tail that is uncovered. Our solution tracks those tails, along with other smaller orders that aren't immediately hedged, and links them up to the hedge order that is later placed to cover them. That hedge order can be placed manually, or automatically by the HM if Auto Hedge is enabled.

There are 3 levels of hierarchy in this widget:

- The top-level is the Hedge Account + Contract (Symbol), showing the "tails" (or unhedged) quantities as calculated by the client and the unhedged quantity in the HM. There is a button for the user to adjust the unhedged balance in the HM for this Account+Contract. Consequently, the tails amount in the HM may differ from the actual quantity. There is a button for the user managing this hedge account to place an offer now.

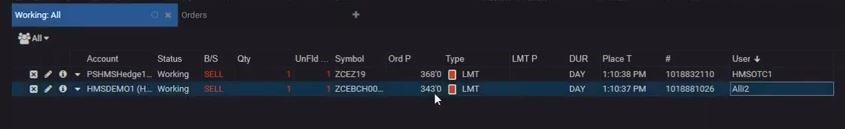

- The 2nd level has 1 row per hedge order. Hedge orders cover, or reduce the Unhedged quantity. Hedge orders can be placed by the HM or from any interface by any trader.

- The 3rd level has 1 row per cash order. It shows the order #, the size of the order, and the amount of the order quantity that was hedged by the 2nd level hedge order. The same cash order will show under 2 or more hedge orders when there is more filled quantity in the cash order than the hedge order can cover.

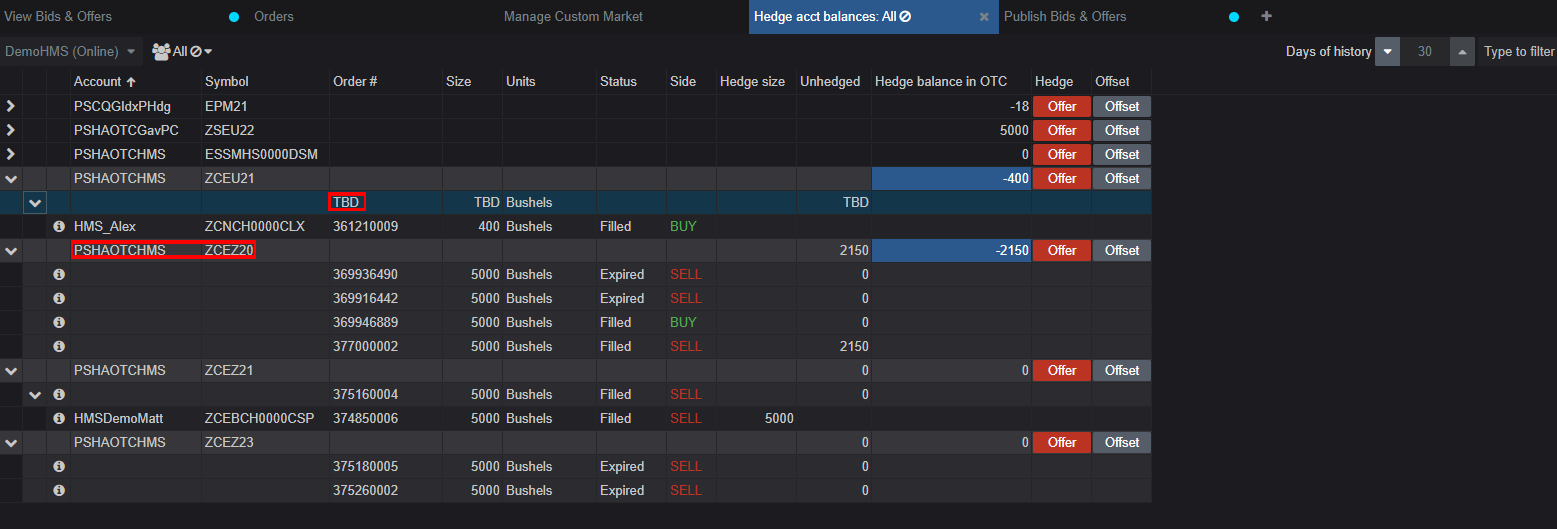

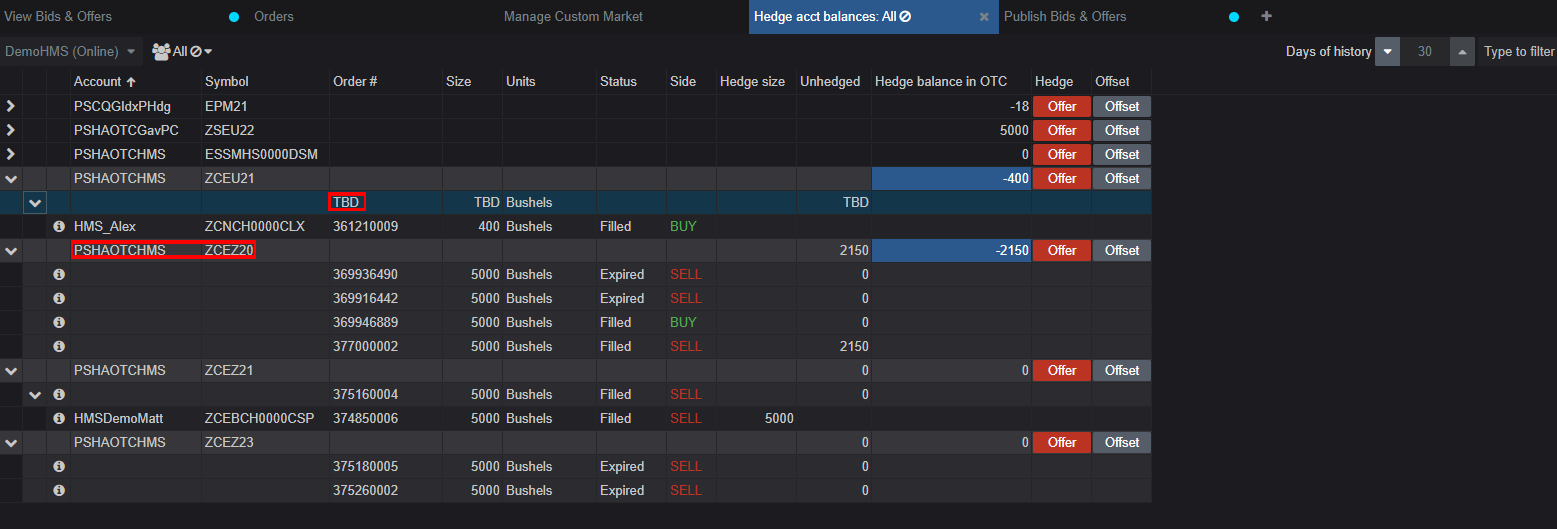

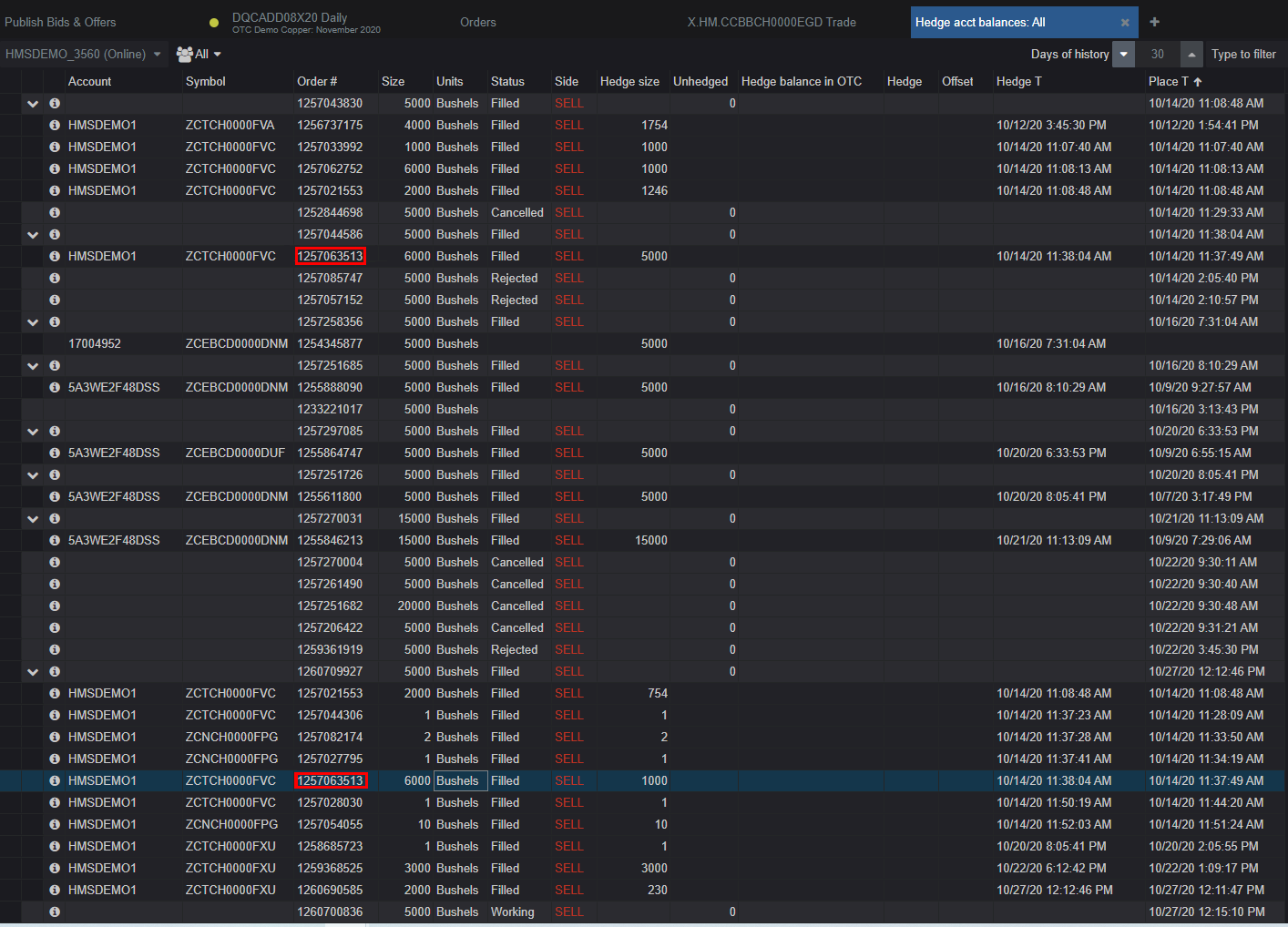

Below is an example of the Hedge Account Balances widget. Notice in the upper right of the widget there is a field to specify how many days of history to request. Maximum look back period is 30 days.

In this example, the first expanded top level shows the hedge order as “TBD.” This is because there was a cash order placed that didn't trigger a hedge order. The next buy hedge order on that account and symbol will replace the TBD row and cover that unhedged quantity. The 2nd expanded row, on PSHAOTCHMS + ZCEZ20 shows only outright orders; no cash orders are covered. The outright orders will offset each other.

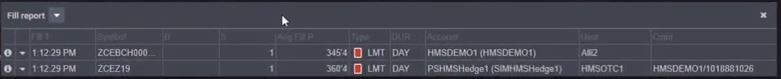

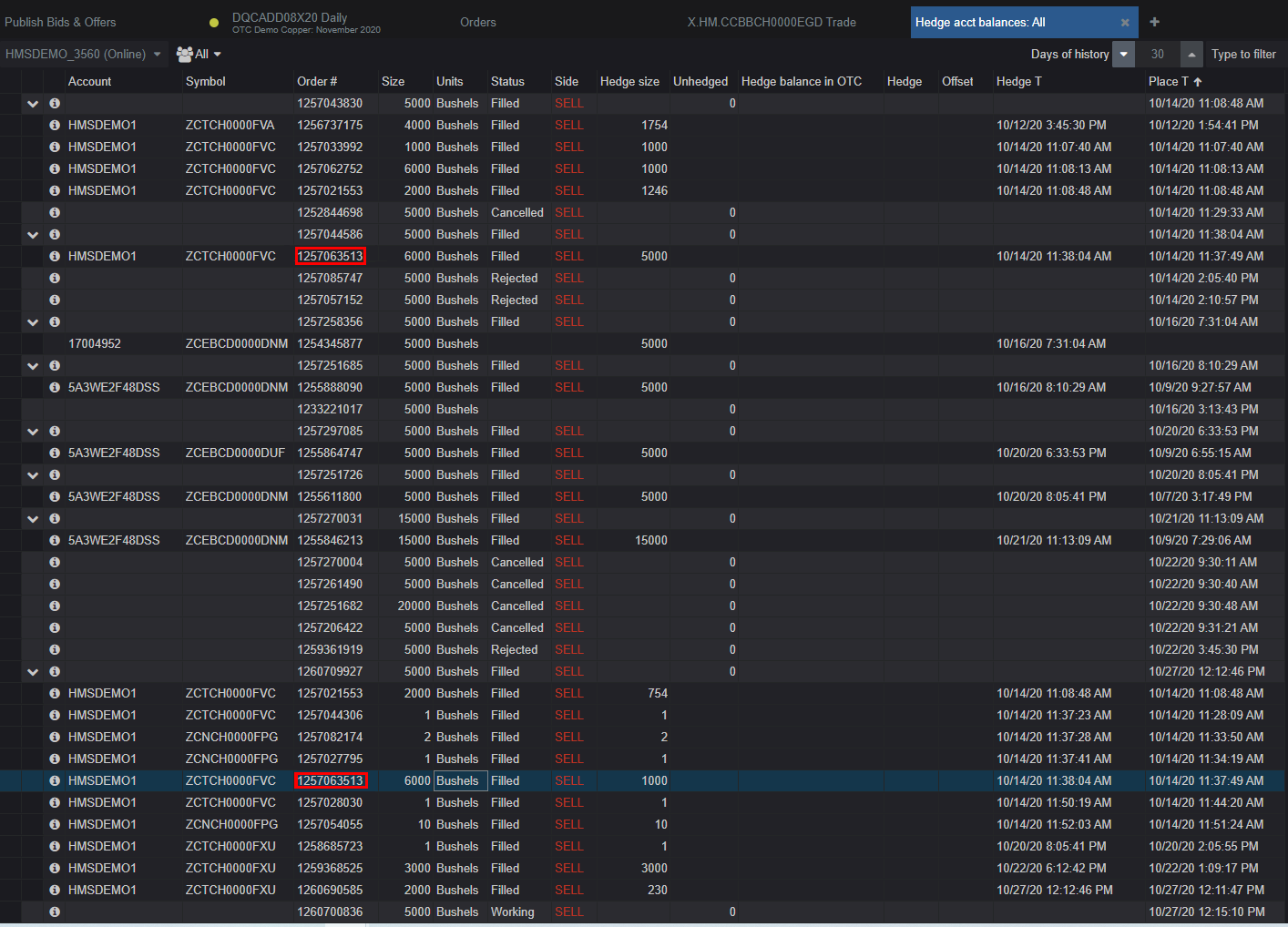

The next example below shows that when the cash order was placed, circled in red, the first 5000 bushels was immediately covered by hedge order 1257044586, and the remaining quantity was covered by order 1260709927, circled in red, that was placed 13 days later.

All of the hedge orders in between those times were fully covering their linked cash orders. Only on the 27th was that auto hedge order filled that could cover the remaining 1000 bushel tail.

Auto-Hedge

All auto-hedge settings are set/modified by sending the request to CQG FCMSupport.

Auto Hedge is enabled for the HM exchange with optional overrides per futures exchange.

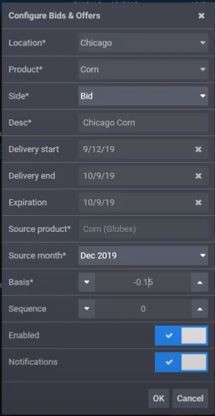

The main parameter is called TailManagementMode, see below. We can also specify how many ticks into the market to place the limit auto hedge order, defaults to 0.

If TailManagementMode is enabled, the hedge threshold parameter must be set. The threshold is the percent of the futures contract size that must be met by uncovered tail quantity before the HM will place a hedge order.

| TailManagementMode parameter

|

Track tail balance per hedge account + source contract

|

Track links between cash and hedge orders, see Hedge Account Balances widget

|

Places Sell orders to keep balance < threshold

|

Places Buy orders to keep balance > threshold

|

| Auto

|

Yes

|

Yes

|

Yes

|

Yes

|

| Buy

|

Yes

|

Yes

|

No

|

Yes

|

| Manual

|

Yes

|

Yes

|

No

|

No

|

| Sell

|

Yes

|

Yes

|

Yes

|

No - allows merchandiser to manually overhedge (i.e. before markets close)

|

Note: when auto hedge is enabled, the hedge accounts configured as default in HM exchange and those set per prefix, should not be used for manual trading. If they are, then HM will just place an opposite order after a fill that pushes the hedge balance out of the threshold range.